In the world of forex and Contracts for Difference (CFD) trading, the safety of client funds is one of the most critical factors investors consider when choosing a platform. Compared with short-term returns or trading conditions, long-term trust is built primarily on transparency, regulatory compliance, and sound risk management.

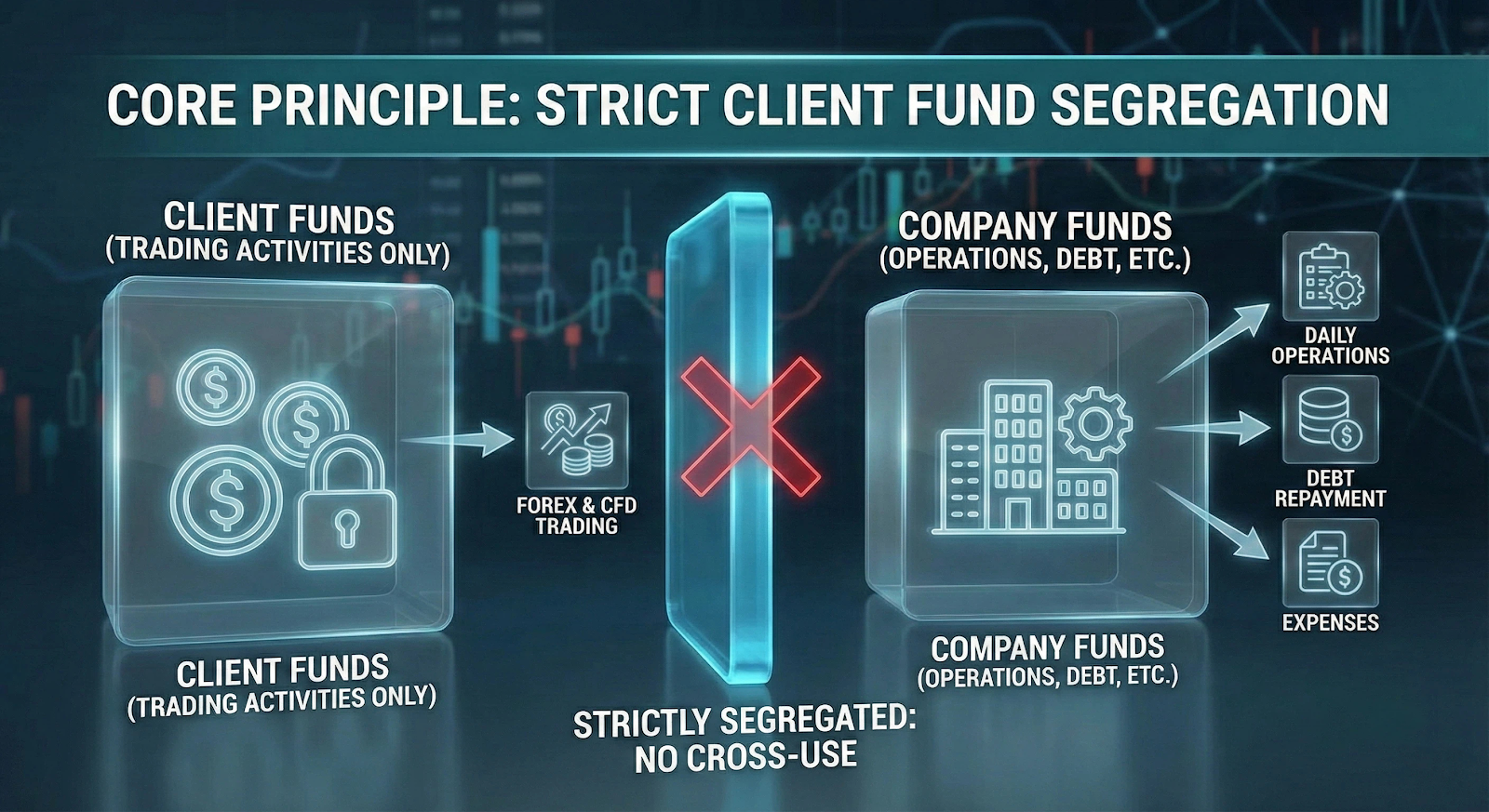

Core Principle: Strict Client Fund Segregation

Merin Global firmly implements a strict client fund segregation policy. Under the platform’s internal risk control and compliance framework, all client funds are fully segregated from the company’s own operational capital. Client deposits are used exclusively for individual trading activities and are never applied to company operations, debt obligations, or any non-trading purposes.

This approach ensures that client assets remain independent throughout the platform’s operations and aligns with widely recognized international standards for client asset protection.

Fund Custody: Partnerships with Tier-1 Global Banks

Merin cooperates with top-tier international banks for the custody of client funds. These banks maintain high credit ratings, strong operational stability, and are subject to rigorous oversight. By utilizing established global banking institutions, Merin reduces external financial risks and provides clients with a stable, transparent, and secure custody environment.

Regulatory Foundation: Compliance as the Bedrock of Safety

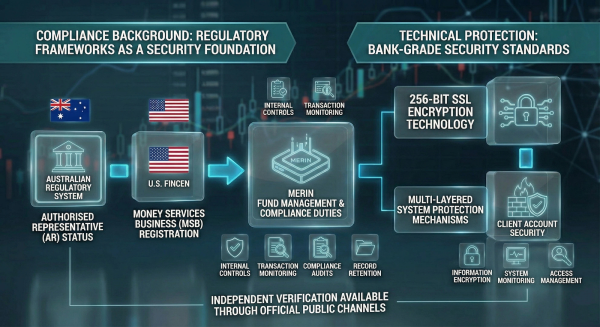

Merin’s fund management framework is supported by multiple layers of regulatory compliance, including Authorised Representative (AR) status under the Australian regulatory framework and registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN).

Under these regulatory requirements, the platform must fulfill ongoing obligations such as internal controls, transaction monitoring, compliance audits, and record-keeping. These measures help ensure transparency, traceability, and standardized handling of client funds. Relevant regulatory registrations and status information can be independently verified through official public channels.

Technical Security: Bank-Grade Protection Standards

In addition to fund management safeguards, Merin places strong emphasis on data and account security. The platform employs 256-bit SSL encryption and multi-layered system defenses to protect data transmission and account access. These bank-grade security standards reflect encryption, system monitoring, and access controls commonly used by financial institutions, helping reduce risks related to cyber threats and data breaches.

Ongoing Risk Management: The Key to Long-Term Stability

Merin believes that effective risk control depends on consistent, auditable, and verifiable daily operations rather than one-time declarations. Compliance and risk management are treated as the foundation of sustainable development. The platform continuously refines its internal controls and maintains close cooperation with partner banks to ensure reliable protection of client funds under all market conditions.

As global financial markets evolve, Merin remains committed to strengthening fund safety through regulatory adherence, banking partnerships, and ongoing technological upgrades.

Risk Disclosure

Forex and CFD trading involve a high level of risk and may result in the loss of part or all of your invested capital. These products are not suitable for all investors. You should fully understand the risks involved and carefully assess your financial situation and risk tolerance before trading.

This article is compiled based on publicly available information and is provided for reference only.

Media Details

https://www.meringlobalforex.com/

Elizabeth

US NY